The global cashew market stands at a pivotal juncture as recent tariff changes by the United States add new complexities to existing supply-chain trends. In July 2025, the US implemented a 25% tariff on cashew imports from all origins, only months after a 10% global cashew tariff took effect in May. While Indian exporters—the world’s leading suppliers—downplay the likely direct impact on their business, citing the US as a minor destination for Indian cashews, the ripple effects on prices, consumption, and trade flows are still unfolding. The US consumes around 18–20% of global cashew output, so higher retail prices are expected to trigger a short-term decrease in demand, potentially softening global prices.

However, exporters remain confident that, as with past shocks, the market will absorb the adjustment with limited disruption. The evolving landscape favors African nations like Côte d’Ivoire and Benin, which benefit from lower tariffs and are expanding domestic processing, challenging India’s dominance in the long-term.

🌍 Supply & Demand Drivers

US Tariffs: 25% on all cashew imports, softening short-term US demand but minimal direct impact on Indian exporters due to marginal US market share.

African Expansion: Côte d’Ivoire, Benin, and other West African nations boosting domestic processing with advantage from lower tariffs.

Indian Perspective: Expected resilience, as global consumption shifts are normalizing and previous 10% global tariff already absorbed.

Global Demand: Short-term dip in US retail demand, but no major shift projected in global trade flows. EU and Asia remain strong alternative destinations.

📊 Fundamentals and Market Data

Production Share (2024 est.):

Côte d’Ivoire (~940k tons), Vietnam (~550k tons), India (~650k tons including imported raw cashew nuts)

Key Importers: US (~18–20% of world consumption), EU, China

Global Stocks: Remain comfortable after two successive years of strong crops in Africa and Vietnam; India reporting manageable stock levels.

Speculation: Limited speculative activity, as sentiment is largely driven by fundamental supply-demand factors.

☁️ Weather & Yield Outlook

West Africa: 2025 rainy season has seen above-average rainfall, supporting good pod development—Côte d’Ivoire forecasts a robust crop, though some localized flooding has raised harvest and drying risks.

Vietnam: Wetter than average in main growing zones; no significant adverse events reported. Expectations for steady output.

India: Timely monsoon onset, slight delays in Kerala and Maharashtra but forecasted average yields. Weather risk remains moderate for coming weeks.

🌐 Global Production and Trade Comparison

| Country | Est. 2024 Production (k tons) | Main Export Markets | Trend |

|---|---|---|---|

| Côte d’Ivoire | 940 | Vietnam, EU | Up |

| Vietnam | 550 | US, EU, China | Stable |

| India | 650* | Middle East, EU | Stable |

| Benin | 250 | Asia, EU | Up |

| Brazil | 140 | EU, US | Flat |

*Includes imported raw nuts for processing.

📆 3-Day Regional Price Forecast

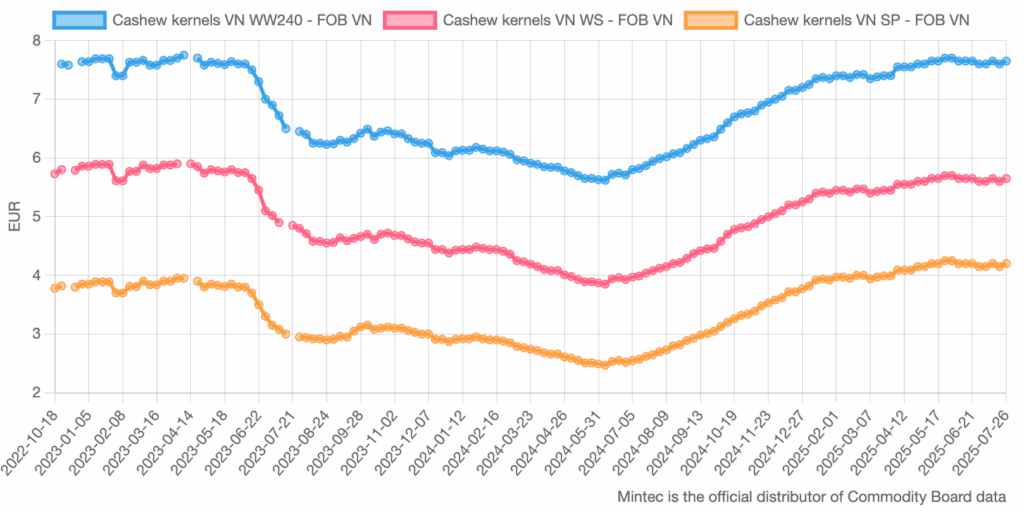

- Vietnam (FOB, WW240): EUR 7.60–7.70/kg (steady to slightly firm)

- India (FOB, W320): EUR 6.90–7.10/kg (sideways, slight downside risk)

- Netherlands (FCA, WW320): EUR 5.15–5.30/kg (stable on steady EU demand)

🔎 Trading Outlook: Key Insights & Recommendations

- Medium-term trend is sideways, as global surplus absorbs temporary US demand dip.

- Monitor weather in West Africa—localized flooding or drying may affect late harvest quality and supply.

- Watch for possible EU buying activity as prices remain competitive and stocks are ample.

- African processors are expected to capture incremental market share in the medium- to long-term, intensifying competition for Indian kernels.

- Price downside may be limited by robust Asian demand and stable logistics; look for stability barring further policy shocks.

📌 Source: Commodity-Board.com – July 2025