As Vietnam’s cashew industry prepares for the 2026 season, securing raw cashew nut (RCN) supply remains the most decisive factor in maintaining global competitiveness.

Despite fluctuations in logistics and climate conditions, importers and processors are entering the new cycle with better planning, improved traceability, and early coordination with African exporters.

According to VINACAS and the African Cashew Alliance, global RCN output in 2025 rose by about 3–4% compared to the previous year. Total imports into Vietnam are projected to surpass 1.8 million tons, reaffirming its role as the world’s largest RCN importer and processor — accounting for over 60% of Africa’s exportable volume.

🌍 Evolving Supply Landscape

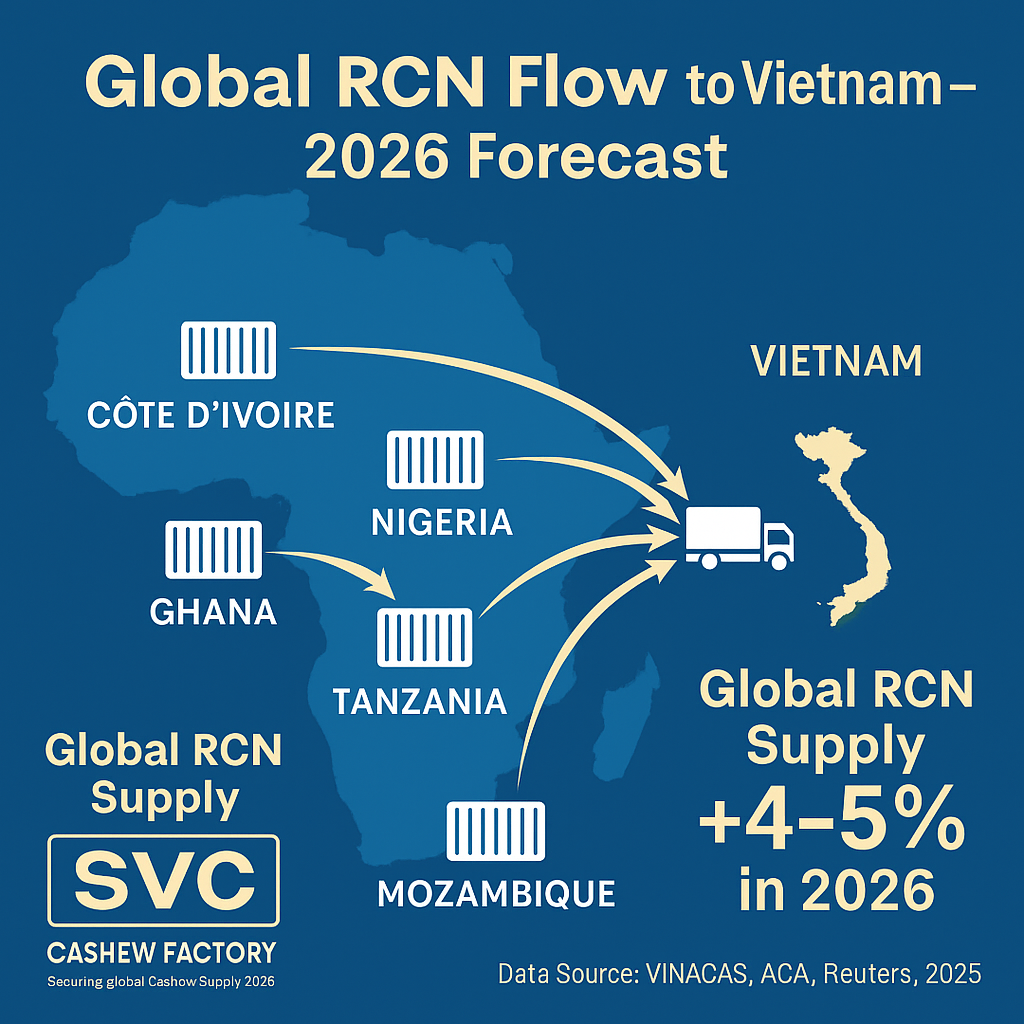

West Africa remains the dominant source of RCN for Vietnam, contributing nearly two-thirds of the total supply. Côte d’Ivoire continues to lead exports with improved drying and grading systems. Production in Nigeria and Ghana has also recovered slightly after a difficult 2024, showing a 2–3% increase in exportable yield.

Meanwhile, East African suppliers such as Tanzania and Mozambique have strengthened their logistics efficiency, offering higher kernel out-turn ratios and better quality consistency. Tanzania’s RCN quality, for example, now averages KOR 50–52 lbs, up from the previous season, with total exportable volume expected to rise by 5–7%.

In Southeast Asia, Cambodia and Laos continue to serve as supplemental origins, supplying fresher RCN that help Vietnamese factories balance quality during peak months.

⚙️ Vietnam’s Procurement Strategy for 2026

Vietnamese processors, led by major exporters such as SVC International JSC, are adopting a more proactive approach to RCN procurement.

Key strategies include:

- Long-term purchasing contracts signed ahead of the West African harvest to minimize price volatility in Q1.

- Direct coordination with African exporters to reduce intermediary costs and shipping delays.

- Quality certification at origin, including moisture, nut count, and KOR analysis before shipment.

- Diversification of sourcing between West and East Africa to spread risk.

- Increased warehouse control and digital tracking to meet BRC and FSPCA traceability standards.

By implementing these measures, SVC ensures uninterrupted input for kernel processing and OEM production — protecting buyers from fluctuations in global supply and logistics challenges.

💹 Market Dynamics and Financial Impact

Industry analysts note that global RCN trade volume is expected to increase by 4–5% in 2026, but pricing trends will depend heavily on freight conditions and climatic factors in Africa.

- Freight stability: Ocean freight rates on Asia–Africa routes have remained moderate since mid-2025, offering a more predictable cost base for importers.

- Currency resilience: The stable USD/VND exchange rate around 25,400 supports financing flexibility for Vietnamese buyers.

- Capital rotation: Many processors are maintaining smaller but more frequent purchases to optimize cash flow and storage costs.

At the same time, global buyers are shifting toward sustainable and traceable sourcing, which favors exporters like SVC that have already integrated quality and certification systems from raw input to final shipment.

📈 Outlook for 2026

Forecasts indicate a steady to slightly bullish RCN market in early 2026, with prices expected to rise modestly (around 3–5%) compared to late 2025 if West African yields tighten.

The growth in roasted and flavored cashew consumption globally will continue to drive kernel demand, reinforcing the need for Vietnam’s factories to maintain stable RCN imports year-round.

SVC International JSC will continue to lead the effort in building long-term partnerships with both suppliers and buyers, ensuring that every stage of the supply chain — from farm to finished kernel — meets global standards of quality, safety, and transparency.

📧 For OEM & RCN Supply Coordination: thanh@svc.vn | thanh@svcfoods.vn

📱 WhatsApp: (+84) 909 432 477

📌 For accurate and up-to-date RCN pricing, please contact SVC directly.