Executive Summary

The global cashew market in mid-August 2025 remains stable yet cautious. Buyers are active but limit purchases to moderate volumes, balancing inventory with steady supply from Vietnam, India, and West Africa.

- FOB HCM Prices: • WW320: 7.00 USD/kg (22.68 kg PE/carton) • A180: 7.90 USD/kg (2×10 kg tin box/carton)

- Market Mood: Sideways to slightly firm trend, awaiting Q4 holiday demand.

Market Overview

- Demand: Consistent in the US and EU retail channels, while the Middle East shows resilience in premium grades (A180, A240).

- Supply: Vietnam maintains stable output with competitive pricing, while West Africa’s 2025 crop has added pressure to the global supply chain.

- Outlook: Prices are expected to stay steady in the short term, with potential upside toward Q4.

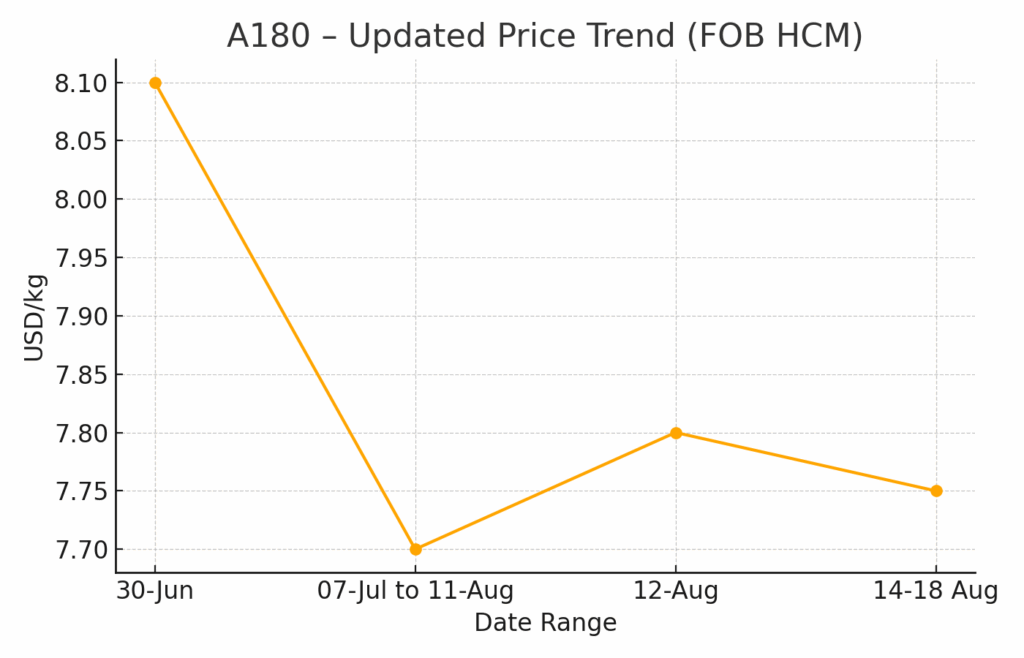

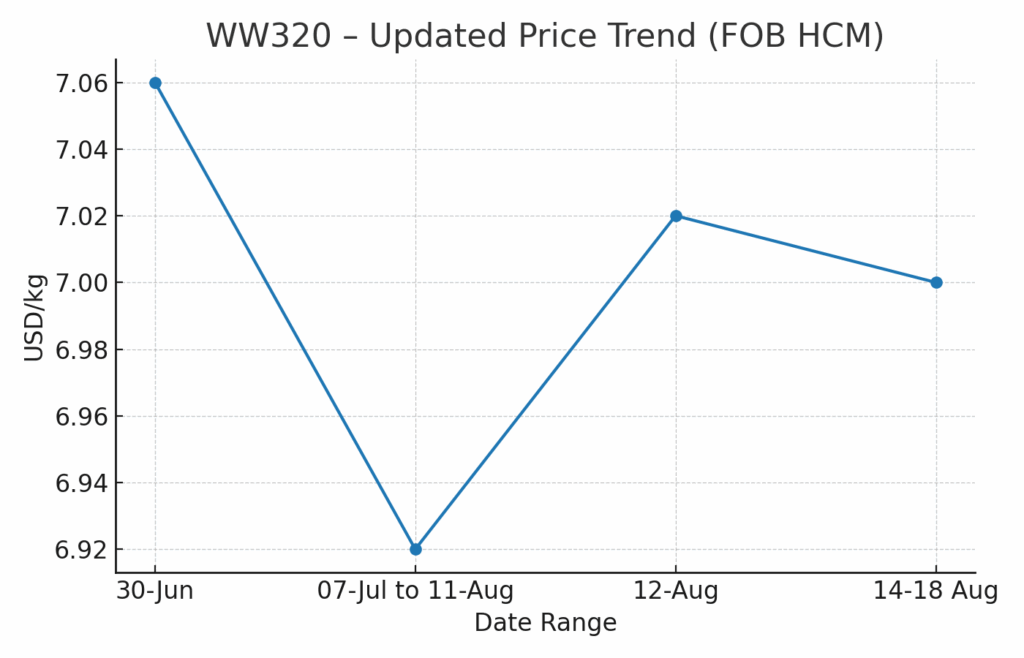

Current Price Trends (FOB HCM)

- WW320 – Most demanded export grade, favored by retail and private-label buyers in EU and North America. Its balance of size and price keeps it the benchmark grade.

- A180 – Premium large-size kernels, highly popular in Middle Eastern gifting markets. Limited supply supports pricing despite slower buying momentum.

Global Context

- US Tariffs: Earlier tariff adjustments have been absorbed; Vietnam remains competitive in global offers.

- African Expansion: Côte d’Ivoire and Benin continue to increase local processing, strengthening Africa’s role in global supply.

- Consumption Outlook: Retail demand in EU and US expected to rise in Q4, potentially lifting prices modestly.

Price Charts & Weekly Movement

📊 Indicative Weekly Price Trend (Past 8 Weeks, FOB HCM)

- WW320: 6.92 → 7.00 USD/kg (sideways, stable)

- A180: 8.05 → 7.90 USD/kg (mild downward correction)

(See attached charts for detailed movement.)

Key Market Drivers

- Freight costs – rising container rates could push CIF prices higher even if FOB remains stable.

- Currency shifts – a stronger USD pressures price-sensitive markets.

- RCN supply – West Africa’s good harvest keeps raw material supply stable.

- Seasonal demand – Q4 holiday restocking will determine firmness of late-2025 prices.

Outlook & Recommendations

- Short-term (2–4 weeks): Prices likely to remain sideways; WW320 at 6.95–7.05, A180 at 7.85–7.95.

- Medium-term (Q4 2025): Holiday-driven demand may add slight firmness, especially in premium grades.

- Buyer Strategy: Secure mid-size volumes now at stable rates, and lock premium A180 early for holiday gifting demand.

👉 Explore more products: Vietnam Cashew Products

📞 Contact for Orders & Samples

- 📧 Email: thanh@svc.vn

- 📱 WhatsApp: +84 909 432 477