Ho Chi Minh City, Vietnam – As one of the world’s top three rice exporters, Vietnam continues to strengthen its role in global food security. Entering the second half of 2025, international buyers are closely monitoring price movements, competition from India and Thailand, and the long-term reliability of Vietnam’s rice supply.

📊 Global Price Movements

According to FAO’s Rice Price Update, the All Rice Price Index fell by 1.8% in July 2025, reflecting improved harvests and strong global supply. This marks a more stable environment compared to the sharp price spikes seen in 2023–24. Buyers now benefit from steadier offers across major origins.

For Vietnamese exporters, this stability means continued competitiveness in both bulk and premium rice categories, particularly in the Middle East and Africa where demand for fragrant jasmine rice and long-grain white rice remains strong.

🌍 Vietnam Export Outlook

The USDA August 2025 update revised Vietnam’s MY2024/25 rice export forecast upwards to 8.5 million metric tons, supported by strong shipments to China, Bangladesh, and Turkey. Other trade monitors, however, estimate around 7.5 million tons for calendar year 2025, citing government-led crop diversification programs that could slightly reduce output.

Regardless of variation, Vietnam maintains its position as the second-largest rice exporter in the world, ensuring strong supply reliability for global importers.

🇮🇳 Competition from India & Thailand

India, the world’s largest rice exporter, has relaxed its 2023 export restrictions and announced a record harvest in mid-2025. This surge in supply has intensified competition, especially in the Middle East and Africa, where India dominates parboiled and Basmati segments.

Thailand, meanwhile, continues to market itself as a premium supplier of jasmine rice, but Vietnam remains highly competitive in pricing while maintaining strong quality standards.

📦 Key Import Markets for Vietnamese Rice

- GCC (UAE, Saudi Arabia, Qatar, Kuwait, Oman): High demand for fragrant jasmine rice with Arabic–English labeling, used in retail and foodservice.

- West Africa (Nigeria, Senegal, Ghana): Bulk imports of long-grain white rice (25kg/50kg PP bags) distributed through wholesale networks.

- Europe & Asia-Pacific: Growing niche for organic and specialty rice, alongside long-term institutional tenders.

👉 Product details: Vietnam Rice

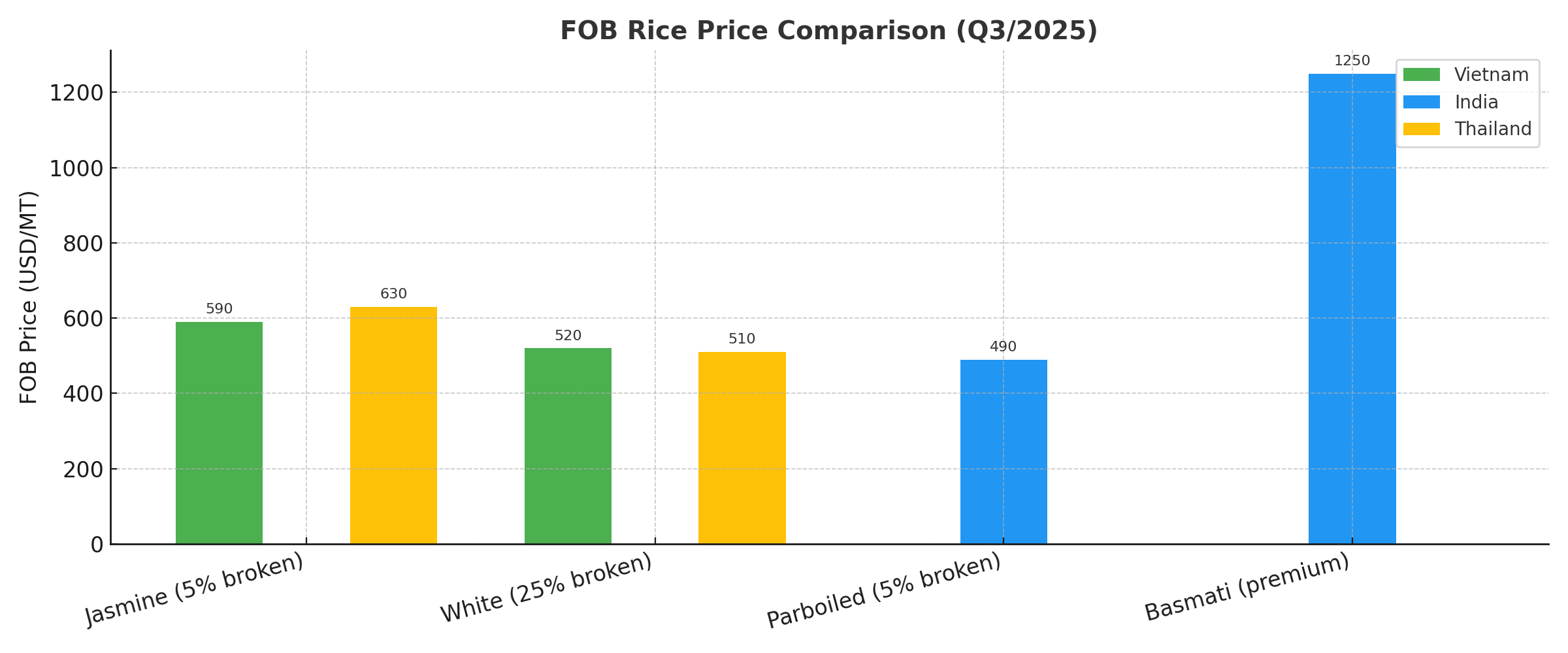

📊 Comparative FOB Prices (Q3/2025)

| Origin | Grade / Type | FOB Price Range (USD/MT) | Notes |

|---|---|---|---|

| Vietnam | Jasmine / Fragrant (5% broken) | 580 – 600 | Strong GCC & Africa demand |

| White Long-Grain (25% broken) | 510 – 530 | Popular in West African markets | |

| India | Parboiled 5% broken | 480 – 500 | Highly competitive, record harvest |

| Basmati (premium) | 1,200 – 1,300 | Premium for Gulf & high-end retail | |

| Thailand | Jasmine 5% broken | 620 – 640 | Premium positioning, stable demand |

| White 25% broken | 500 – 520 | Competes directly with Vietnam |

📌 Analysis:

- Vietnam’s jasmine rice remains cheaper than Thailand’s while retaining quality, making it attractive for GCC buyers.

- India dominates in parboiled and Basmati rice, but these categories serve different consumer segments.

- Buyers often combine sourcing: Vietnam jasmine + India Basmati to balance quality and cost.

🔮 Outlook for 2025–2026

- Stable export levels: Expected above 7.5–8.0 million tons annually.

- Premium opportunity: Fragrant jasmine rice remains Vietnam’s competitive edge.

- Retail growth: Strong potential for OEM/private-label packs in GCC and Africa.

- Risk factors: Weather fluctuations (El Niño/La Niña) and domestic crop-switching policies.

📞 Contact for Rice Imports

📧 Email: thanh@svcfoods.vn

📱 WhatsApp: +84 909 432 477